The Main Reason An Organization May Hire An Outsourced Cfo:

The current growth is bringing new products to the market or expanding into new countries. An outsourced CFO may have previous experience in similar markets, products, or industries, and will can provide guidance on strategy. A CFO outsourced to an outsider can help with cost management, risk assessment, as well as maximising profits. A CFO that has been outsourced has likely dealt in similar situations before and knows how to create and implement lasting, long-term improvements.

The process of raising capital for debt or equity. A consultant can help you in raising capital. Maximize margins by analyzing your current pricing and cost structures. Your CFO will analyze your financial statements to find areas of improvement, and then help you execute them. Have a look a this best outsourced cfo services for more information.

Part-Time Consultation And Advice On Strategy.

Scaling systems to handle the growth of business and increase in complexity such as sales, financial operational, or business systems; new or upgraded systems need to be implemented. If a CFO who is full-time cannot be replaced or is currently being installed in the first place time, an interim CFO could be needed. Temporary interim CFOs are someone who manages the financial strategy of an organization that requires CFO. Consult with an already-employed CFO. While some businesses may have an internal CFO, this CFO may not be able to solve an issue or achieve a goal like designing a system or capital raising so forth. Outsourced COFOs can consult or advise an already-in-place CFO to boost the performance of the finance team and improve the overall financial strategy and transfer their valuable knowledge.

The Preparation Of An Annual Financial Forecast.

Forecasts are essential for many reasons, including budgeting, fundraising, analyzing the health of a company and projecting growth, restructuring etc. A CFO who is outsourced with extensive forecasting knowledge will be able to give precise forecasts that are based on your long-term goals.

Are I a Controller, CPA, or CFO needed?

An CPA or accountant can guarantee compliance with tax laws as well as financial records. An outsourced controller keeps financial records accurate. However, a CFO is accountable for financial strategy, insight, execution, and planning that looks to the future. Have a look a this "outsourced cfo firms" for details.

Why Would You Hire An Outsourced Cfo Over An In-House Cfo?

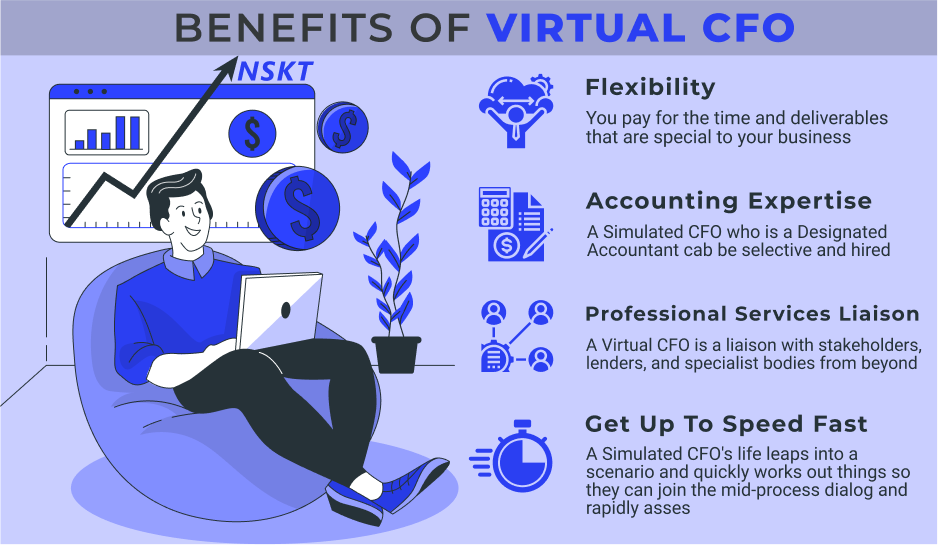

A CFO is able to help any company establish a strategy and fine-tune its operations, business contacts, and other key capabilities. But not every company can afford or has the funds to employ a full-time CFO. An in-house hire typically means the annual salary plus benefits which, for an executive in the C-suite, could often be cost-prohibitive, especially when you think about annual raises. Many companies must compromise experience and expertise in order employ an accountant who is cost-effective. When you choose to hire an Outsourced CFO However, your money "goes further" because you're "sharing" the CFO's work and only paying for the time and knowledge you require. It is possible to have an experienced CFO outsourced for an equivalent monthly cost or less, with no benefits or annual increases. You can also work with a CFO who's familiar with the particular challenges you are facing. In general, outsourced CFOs typically have a broad spectrum of project, business size, and experience in the industry. This means they are familiar with the challenges faced by companies similar to yours, and will help you solve the issues. The top Outsourced CFOs have full access to finance and accounting expertise. This allows them to create temporary or long-term teams that meet their client's primary objectives. A CFO outsourced to Outsourcing can create teams with diverse skills and expertise in their field, and this is often less expensive than the costs of a full-time dedicated CFO.